Altoona’s economy is growing with our population, and the numbers are showing it. With residents engaging in competitive industries like engineering and business, Altoona has cultivated the highest per-capita and median household income in the region. Our family-centered population is expanding, and small and large corporations through the region are utilizing the skilled area workforce. Altoona’s growing—as a community and a hub for business. Altoona’s time is now.

Resources Now

With a proven track record for close coordination between business and the community, Altoona partners with organizations like the Greater Des Moines Partnership and Iowa Economic Development Authority to drive the region’s growth. Below are some of the resources available for businesses looking to expand or relocate.

City of Altoona

The City of Altoona’s Community Development Department is working across the board to coordinate healthy expansion. It’s an effective collaboration between the Altoona City Council, Planning and Zoning Commission, Board of Adjustment and the general public. Through the cooperation of developers and residents, the Department is planning and executing our city’s growth, while preserving the beautiful environment where we live.

altoona-iowa.com

Altoona Area Chamber of Commerce

The Altoona Area Chamber of Commerce is developing our community while maintaining our flourishing business and tourist environment. A non-profit membership organization, the Chamber represents the professional community of the Altoona area. They strive to benefit its members, the Altoona people and visitors to the area.

altoonachamber.org

Greater Des Moines Partnership

The Greater Des Moines Partnership is collaborating with businesses to relocate or expand their operations. Together with the City of Altoona, the Partnership utilizes specialized industry research and partnerships—coordinating with local, state and national entities—to provide comprehensive assistance in site selection.

Iowa Economic Development Authority (IEDA)

The IEDA’s goal is to support development in Iowa, and in doing so, strengthen economic and community vitality. By administering state and federal programs, they’re building partnerships and leveraging resources. IEDA is establishing Iowa and Altoona as the right choice for people and businesses.

iowaeda.com

Iowa Innovation Corporation

The Iowa Innovation Corporation is attracting businesses with big ideas. As Iowa’s designated innovation intermediary, the Corporation’s committed to working with the business-led Iowa Innovation Council. Together, they’re fostering the state’s innovation-based economy.

iicorp.com

financesNow

Tax Increment Financing (TIF)

The City of Altoona may designate an urban renewal area as a tax increment district for a specified number of years. An increase in the property tax revenue within that district may then be used by the City for economic development purposes through grants or loans to private enterprise as an incentive to locate within that area.

Export Trade Assistance Program (ETAP)

This program reimburses eligible Iowa companies for up to 75% of defined international marketing expenditures in a qualifying trade show or IEDA trade mission held outside the United States in order to explore new markets or provide support to expand current markets.

Domestic Trade Assistance Program (DTAP)

This program reimburses eligible Iowa companies for up to 75% of defined international marketing expenditures in a qualifying international trade show held in the United States, to explore new international markets or provide support to expand current markets.

Demonstration Fund

The Demonstration Fund provides financial and technical assistance to encourage high technology prototype and concept development activities that have a clear potential to lead to commercially viable products or services within a reasonable period of time.

The Demonstration Fund supports commercialization activities by small and medium-sized Iowa companies in the advanced manufacturing, biosciences, and information technology industries. The primary purpose of the fund is to help businesses with a high-growth potential reach a position where they are able to attract later stage private sector funding.

Proof of Commercial Relevance

This program is designed to define and articulate the business opportunity for businesses that have demonstrated a proof-of-concept for innovative technology. Awards up to $25,000 will be in the form of grants with a 1:2 (Private:Public) match.

Iowa Innovation Acceleration Fund

This fund promotes the formation and growth of businesses that engage in the transfer of technology into competitive, profitable companies that create high paying jobs. The funds are designed to support commercializing research, launching new start-ups and accelerating private investment and industrial expansion efforts that result in significant capital investment.

Angel Investor Tax Credits

Angel Investor tax credits are offered to increase the availability and accessibility of venture capital, particularly for ventures at the seed capital investment stage. Two programs – the Qualifying Business tax credit and the Community-Based Seed Capital Fund tax credits – work together to encourage the creation of wealth through high-paid, new jobs while promoting industrial development and innovation. The total amount of tax credits available per fiscal year is $2 million.

Employee Stock Ownership Plan

An employee stock ownership plan (ESOP) is both a tool for allowing the owners of companies to share the business equity with employees and a retirement plan for those employees.

In addition to the general economic benefits, ESOPs are a promising tool for retaining businesses in Iowa communities. The IEDA has received an appropriation of $500,000 to establish a program to encourage the formation of ESOPs in Iowa. The money will be used to help businesses interested in ESOPs defray the upfront costs of feasibility studies. The State of Iowa offers a 50% deduction from state income taxes for the net gain from the sale of stock to an ESOP. This incentive is not an economic development program but rather a permanent feature of the tax code.

High Quality Jobs Program

The High Quality Jobs program provides qualifying businesses tax credits and direct financial assistance to offset some of the costs incurred to locate, expand or modernize an Iowa facility. To qualify for this very flexible assistance package that includes loans, forgivable loans, tax credits, exemptions and/or refunds, eligible businesses must meet certain wage threshold requirements.

Innovation Fund Tax Credit Program

The Innovation Fund Tax Credit program was created to stimulate venture capital investment in innovative Iowa businesses. Individual investors can receive tax credits equal to 25% of an equity investment in a certified Innovation Fund. In turn, those certified Innovation Funds make investments in promising early-stage companies that have a principal place of business in the state of Iowa. The total amount of tax credits available for investment in Innovation Funds is $8 million this fiscal year.

New Jobs Tax Credit

The Iowa New Jobs Tax Credit is an Iowa corporate income tax credit and is available to a company that has entered into a New Jobs Training Agreement (260E) and expands their Iowa employment base by ten percent or more.

The amount of this one-time tax credit will depend upon the wages a company pays and the year in which the tax credit is first claimed. The maximum tax credit in 2014 will be $1,608 per new employee. Unused tax credits may be carried forward up to ten years.

Research Activities Tax Credit

Iowa sets itself apart, being one of only a few states to offer a refundable research activities tax credit. Iowa companies earn refundable tax credits for research and development investments that may be paid directly in cash to the company once its tax liabilities have been met. A company must meet the qualifications of the Federal Research Activities Credit in order to be eligible for the credit in Iowa.

Brownfield/Grayfield Tax Credit Program

State and federal incentive programs exist that can make the purchase and redevelopment of a Brownfield site a good economic opportunity for many businesses. These incentive programs exist because Brownfield redevelopment can promote general economic health by reducing environmental hazards, cleaning up neighborhood eyesores, creating jobs, boosting tax revenue, and so on. Tax credits are available on an annual basis, with a maximum tax credit per project of $1,000,000 and a $10,000,000 maximum for each fiscal year.

Community Development Block Grant (CDBG)

Administered by the IEDA, the main goal of this program is to develop viable communities by providing decent housing and suitable living environments and expanding economic opportunities, principally for persons of low and moderate incomes. In Iowa, this program can be used to fund public facilities such as water and sewer facilities and community buildings; housing rehabilitation; and economic development and job training. All projects must meet the National Objectives as defined by HUD.

Workforce Housing Tax Credits

Developers building or rehabilitating housing in Iowa may be eligible to receive certain state tax incentives.

utilitiesNow

Electric & Gas

Electric & GasMidAmerican Energy

Business Line: 1-800-329-6261

Emergency (Gas Leak): 1-800-595-5325

Power Outage/Wires Down: 1-800-799-4443

Local Telephone Providers

Local Telephone Providers

Century Link (Business Customers)

Sales & Billing: 1-877-744-4416

Control Center: 1-800-350-1044

24-Hour Repair & Phone Service: 1-800-954-1211

Tech Support: 1-800-247-7285

Windstream

Business Support: 1-800-843-9214

Online Orders: 1-800-481-5441

Internet Technical Support: 1-866-445-0978

Mediacom

Customer Service: 1-855-633-4226

Water, Sewer, Storm Water, Recycling & Trash

Water, Sewer, Storm Water, Recycling & Trash

Businesses moving into the City of Altoona need to contact City Hall and fill out a commercial utility application. The City requires $100.00 deposit. The deposit will be held and if the customer receives no delinquent water bill during the first calendar year then the $100.00 will be credited to the customer’s account after that year. If you move out within the first year, or have a deposit on file, it will be applied to your final water bill.

The City of Altoona requires at least 24-hour notice to have water turned on or off. The City does not typically turn water on or off during the weekend or after hours unless there is an emergency situation.

City Hall is open Monday – Friday 8:00 – 4:30pm.

Contact the Utility Billing Clerk at 515-967-5136 with questions or concerns.

Site Selection

Altoona business is happening now. Strong leadership—from the City of Altoona’s Development Department to the elected officials—means healthy communication and coordinated success for your business.

Incentives, grants and tax credits make the opportunities even brighter. We’re equipped with the leaders, economic tools, utilities and infrastructure to foster long-term development and mutually beneficial partnerships. We’re ready for the next big thing. We’re ready for your business—now.

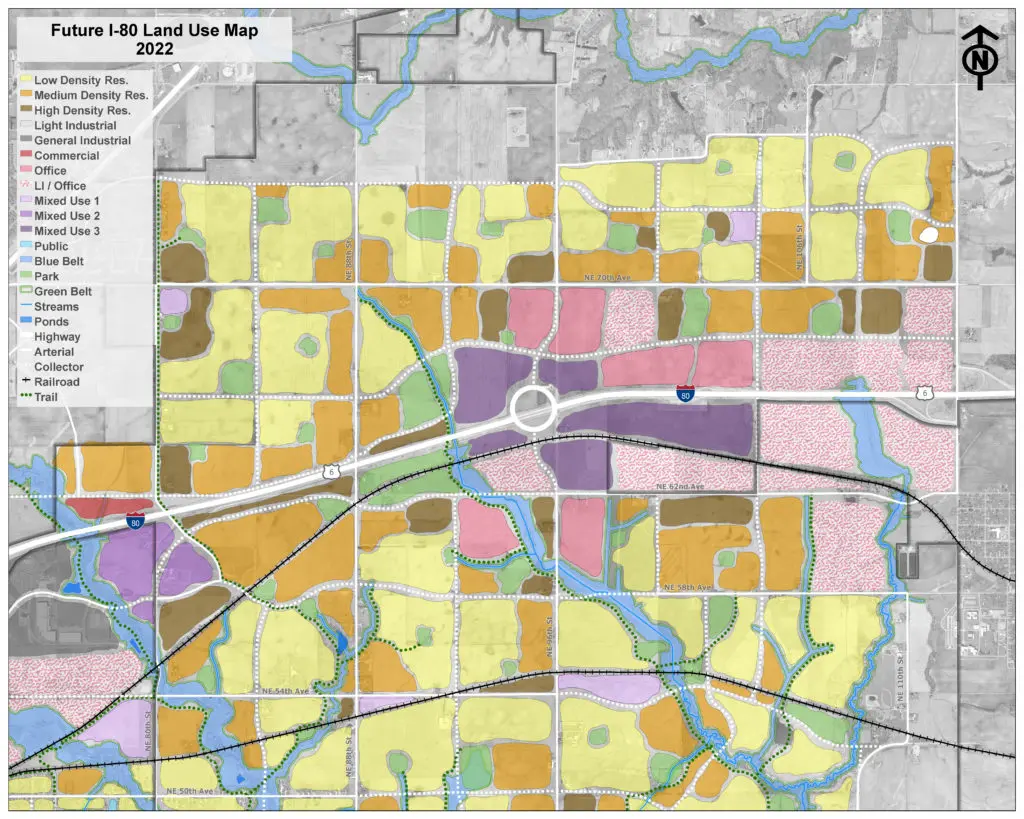

future I-80 land use map

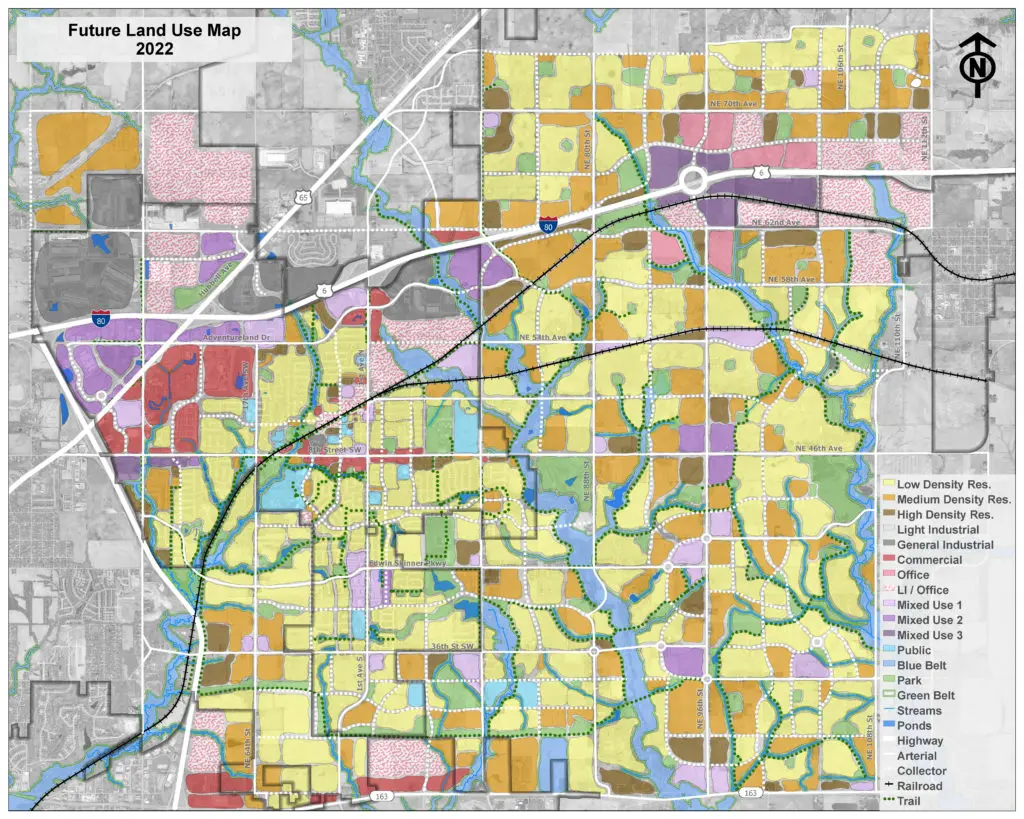

future land use map